NACS releases 2022 data for the convenience industry and retailers report record-high sales, fuel prices, and credit card swipe fees.

In a year of record-high gas prices, retailers recorded record-high sales and credit card swipe fees, according to the 2022 NACS State of the Industry data that was recently released. The $906.1 billion dollar U.S. convenience industry saw fuel sales increase a whopping 41.2% making up $603.2 billion of those overall sales.

NACS reports that the majority of U.S. consumers choose to pay for fuel (and most items) via credit card. Alongside those profits are high credit card processing fees. Retailers paid an astounding $19.5 billion in credit card fees, as reported at the NACS State of the Industry Summit, which is the third highest expense behind labor and direct store operating costs. Credit card processing fees are generally 2.5% for every transaction.

Mobile Fuel Pay Is 2023’s Hottest Trend in Convenience Retail

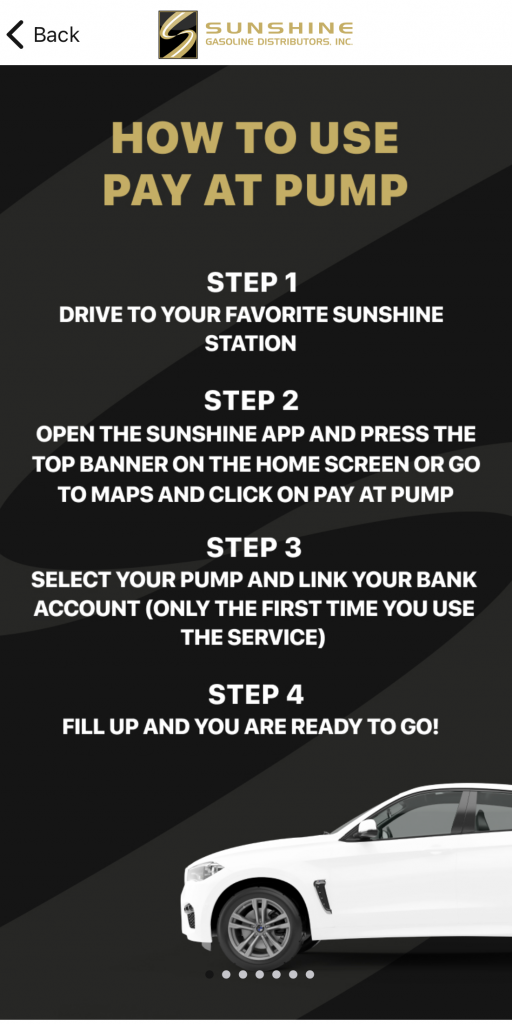

Paying for fuel via mobile app is one of the fastest-growing payment methods in the convenience channel and the race is on to keep up with the competition. Innovative retailer, Eddy Alverez, President of Sunshine Gasoline took that one step further, implementing mobile fuel pay that only accepts ACH and not credit cards. Eddy is not only leading the Florida retail landscape by offering easy and convenient mobile fuel pay but is saving at least 1.5% on every single transaction by avoiding credit card fees. ACH processing fees are usually about 1% on every transaction. West Virginia’s Smith Oil Company and Missouri’s Warrenton Oil Company are both following in Sunshine’s success and deploying their ACH fuel pay platforms this spring.

Accepting ACH Payments Saves 1.5% in Processing Fees on Every Transaction

ACH fuel pay for all three retailers, and several others not yet announced, are powered by Liquid Barcodes C-StorePay. Switching transactions to ACH payment eliminates swipe fees and doubles the profit margin for retailers. From a customer’s perspective, ACH payments deduct directly from their bank accounts, providing a nearly real-time draw of funds, saving retailers costly credit card fees and saving customers costly interest charges.

More and more retailers are announcing their mobile fuel pay, but only Liquid Barcodes C-StorePay links customer bank accounts immediately in just a few steps, unlike other apps that take upwards of 13 steps and a 2-day clearing period.

Lead the competition by implementing ACH mobile fuel pay today!

About Liquid Barcodes

Liquid Barcodes is a leading global loyalty and digital marketing technology company specializing in the convenience and foodservice industries. The proprietary, cloud-based technology platform allows retailers to create and manage their digital marketing campaigns with a process called the “customer connection cycle’ to engage, promote, and reward customers’ activities in real time across digital and media channels.

Liquid Barcodes loyalty platform is powering loyalty programs for industry leaders across several global markets, by offering unique subscription, mobile payment, machine learning, personalization, gamification, loyalty, and other capabilities.

Learn more about Liquid Barcodes at LiquidBarcodes.com.

About the Author

Carolyn Schnare, Chief Content Officer, Liquid Barcodes

Carolyn Schnare has been involved with the convenience retailing industry for two decades with extensive knowledge of customer engagement and marketing, sustainability, and community outreach. Prior to Liquid Barcodes, Schnare worked at NACS (National Association of Convenience Stores) in a variety of roles from event production to membership and most recently as Director of Strategic Initiatives and host and producer of the popular industry podcast, Convenience Matters. Schnare currently anchors the popular Shop Talk LIVE! video series produced by Global Convenience Store Focus media group.