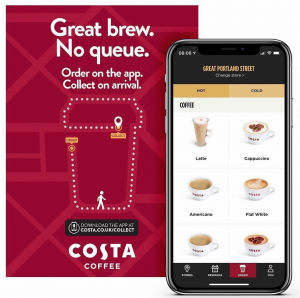

Voted the UK’s favourite coffee shop for the eighth year in a row in 2018 by an independent judging panel, Costa Coffee is clearly doing a fantastic job catering to the tastes of UK customers. Having first reported UK sales of over £1bn in 2016, the brand operates the largest coffee chain in the UK, and also the second largest in the world! Until recently, the most exciting news about Costa Coffee was the announcement by The Coca-Cola Company that they have agreed to buy the business in 2019, however for UK consumers, it’s their “digital revolution” and a “Great Brew. No Queue.” promise that will make the most difference in their everyday lives.

Costa Coffee UK’s Latest In-App Feature

Costa Collect

According to Whitbread PLC which has owned and operated Costa Coffee since 1995, over 1.3mn people have downloaded the Coffee Club app, and like many loyalty apps, it was designed for purely marketing purposes with no operational relevance. With the launch of Costa Collect in over 100 London stores, the app now offers mobile ordering and payment capabilities – benefitting Costa’s store operations and also its customers. This enhancement allows staff to focus on crafting custom drinks for customers instead of processing points and payments, following the industry leader Starbucks, who have offered mobile payments in the US since 2011, and mobile orders since 2015, both with massive success. As the industry leader globally, 30% of its US customers use mobile payments, and 11% of them order and pay on their mobile.

Starbucks app users “spend approximately 3x more than the average Starbucks customer” proving to many brands that innovation and efficiency truly do drive customer loyalty.

Here’s how the Costa Collect feature works in practice:

- The new feature called “Costa Collect” was initially trialled in 2017, and allows customers to place their order and make payment in advance on their mobile phone, for collection in a nearby store.

- With over 100 London stores now offering the service, the company is just now beginning to promote the service with limited announcements in social media channels. No UK press releases have yet been issued about the service – showing a cautious approach to managing customer expectations.

- Not all menu items are yet available with this service which is focused on top-selling items currently.

- The Costa app accepts all UK-issued credit cards except American Express.

- Coffee Club points are tracked and issued for mobile orders exactly as they are for in-store orders.

- At the time of the order, Costa Coffee estimates the time required for each order to be ready for collection. Orders not collected within 15 minutes of that time are disposed of and can no longer be collected. No refunds are offered to these customers.

Here’s how the brand’s loyalty programme “Coffee Club” benefits customers:

- Customers earn 100 points for registering and joining.

- Both plastic cards and an app version are currently in use.

- The customer’s earning rate is 5% with 5 points earned per £ spent in-store or on the app.

- In addition to the points benefits, members enjoy unlimited free wifi, special invitations and exclusive offers.

- Originally only customers buying their coffee in Costa Coffee stores were awarded Coffee Club points, however with recent technology enhancements, now even customers using any of the 6,000 UK ‘Costa Express’ self-service machines can also enjoy the loyalty programme’s recognition and rewards.

Costa Coffee’s App in iTunes

Costa Coffee’s App in iTunes

Creating Shareholder Value

As the current parent company of Costa Coffee, Whitbread PLC has delivered extraordinary value for shareholders with its impressive dominance of the UK coffee market and its growth performance internationally, in addition to growing its self-service machine business. With over 2,400 stores in 31 countries and employing over 16,000 people, Costa Coffee is now over forty years old and is being sold to The Coca-Cola Company for £3.9bn, an extraordinary return for investors, who originally paid £19 million for it in 1995.

Once the acquisition deal closes in 2019, Costa Coffee will join The Coca-Cola Company, whose goal it is “to refresh the world”. While The Coca-Cola Company has committed to allowing “Costa be Costa”, there are definite benefits and synergies that can be leveraged. Coca-Cola President and CEO James Quincy summarised the intended relationship as “connected but not integrated”.

Here are some thoughts on future opportunities the two powerful companies could consider:

- Marketing is perhaps the greatest capability within The Coca-Cola Company. The company has leveraged its heritage and expert consumer strategies to become the 14th most valuable brand in the world. Tapping into this expertise, Costa Coffee will benefit from global “shopper insights” as showcased at the NACS Show in Las Vegas, as well as access to new global distribution channels, with Quincy highlighting the appeal of Costa products to its customer base worldwide, whether for ground or roast beans or for ready-to-drink beverages. Even McDonald’s, Coca-Cola’s biggest customer worldwide could become a potential channel. To date, McDonald’s has developed and marketed their own range of coffee drinks, however in other categories such as desserts they have adopted a partnership strategy alongside their own brand to develop exclusive products such as The Smarties McFlurry. The combined power of The Coca-Cola Company, Costa Coffee and McDonald’s globally could create some interesting strategies and synergies designed to increase overall distribution and consumption. Of course, Costa’s retail store footprint of over 2,400 stores also offers The Coca-Cola company an opportunity to create a dominant distribution channel for its range of over 80 drinks and 20 brands, which includes three colas, a range of sparkling and still drinks, waters, herbal teas, juice drinks and sports drinks.

- Geographical expansion creates another interesting question. Which markets will the newly acquired company focus on once the acquisition closes? Will Costa Coffee use Coca-Cola’s power and presence in the US to enter that market given that it has chosen not to until now? With Costa’s chief taster having insured his tongue for £10 million, clearly, Costa believes it has a sufficiently superior tasting product. It will be fascinating to see whether they use that as a USP to challenge the densely populated US market, or whether it will continue to focus on faster-growing markets such as China which Starbucks is also focused on for its global growth. Even in its home market in the UK, Costa’s competition is increasing. The BBC recently reported that the UK is the nation paying the most for coffee, creating opportunities for challenger brands such as easyCoffee who said “reports of the saturation in [the UK] high street coffee market had been “greatly exaggerated.”

Operationally it seems unlikely that there will be any synergies between the two companies, with Costa recently opening a highly specialised £38 million coffee roasting facility to cater for its global expansion, and expected to deliver the capacity needed for the next 20 – 30 years. Similarly, in the UK, Coca-Cola operates its own six facilities manufacturing drink concentrates and syrups. While the hot and cold drinks categories could not be more different, the operational excellence and insights from operating industrial facilities at such a scale could offer shared learnings between both brands.

Clearly, The Coca-Cola Company is incredibly excited about the opportunities presented by entering the coffee market – a category that’s “one of the fastest-growing beverage categories in the world, at 6%.” Our hope is that Costa Coffee continues to innovate and leverage the incredible resources of its new owners to further enhance their in-store experience and speed up the global roll-out of features such as its new mobile ordering and payment feature.

The UK’s favourite coffee chain has managed to thrive despite Starbucks ‘ year head start launching this key feature in the UK so we will be keen to see whether they can use the increased resources of its new owners to challenge the global giant and perhaps become the world leader in the category.

About Us:

Liquid Barcodes is a leading global loyalty technology company specialising in the convenience store and food service industries. Our proprietary cloud-based technology platform allows retailers to create and manage their digital marketing campaigns with a proprietary process we call the “customer connection cycle’ to engage, promote and reward customers’ activities in real-time across digital and media channels.

How we do it:

We have developed the most advanced loyalty and digital marketing technology platform specifically for convenience store and foodservice retailers globally.

Retailers use our self-service dashboard to create and manage loyalty driven marketing campaigns that increase purchases with their existing customers, as well as effectively target and acquire new customers through partners or paid media channels.

One core component of live loyalty is gamification. We have gamified branding, loyalty and promotions. We believe this approach is essential in order to get customers’ attention and ultimately truly engage them with repeatable actions thereby winning their loyalty.

Check out some of our exciting/proven results here:

About Me:

Chief Content Officer, Liquid Barcodes and Independent Loyalty Consultant.

With over twenty-five years marketing experience, I specialise in loyalty marketing consulting, managing consumer loyalty propositions, strategy and operations. In addition to working with Liquid Barcodes, my clients have included Telefonica O2, Three Mobile, Electric Ireland, Allied Irish Bank and The Entertainer, as well as Avios – the global points currency for some of the world’s top airlines. I am also a judge for the Loyalty Magazine Awards.

—————————————————————————————–