As a loyalty consultant, my role typically involves advising how best to build programmes that ensure both transactional AND emotional benefits for its members. With our best understanding of human behaviour, I have learnt that although we believe our behaviour as consumers to be mostly rational, the opposite is actually true. Brand association, recognition and ‘soft’ benefits often drive our daily purchasing decisions.

But my favourite insight and observation in recent months has been the explosion in the use of loyalty programmes for more practical reasons – as a channel for payments. Clearly points and rewards are still critically important features in any retail application to ensure your customers feel truly rewarded, however the ability to also make payments is a feature which has been quietly but dramatically evolving the power of digital loyalty programmes around the world.

Starbucks have led the way with this insight and customer-focused solution since 2009, when the previously irrelevant QR code format was adapted and incorporated in to their Rewards loyalty programme for payments. Initially launched in just 16 stores, its dramatic adoption led to a global roll-out, resulting in mobile payments now accounting for over 30% of US store transactions, with 11% coming through their Rewards app as pre-orders.

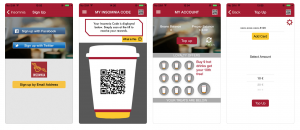

Not to be outdone, Irish coffee chain Insomnia launched similar functionality in 2016, showing how loyalty programmes worldwide are increasingly focused on more than just rewards and recognition, to truly deliver customer-centred solutions that save customers time at the till.

In the United States, brands across all retail sectors from Walgreens and CVS to Dunkin’ Donuts and Chick-Fil-A are implementing mobile payments that integrate with their loyalty programmes, with the realistion that this functionality is driving familiarity and app engagement – the holy grail of loyalty marketing.

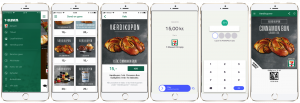

And in our own experience, 7 Eleven in Denmark has also embraced the opportunity presented by this customer behaviour, adopting pre-payment within their loyalty app to become the most popular convenience app in Denmark. As well as the pre-payment benefits to the business, ensuring customers are committed to purchase even before coming in to your store, it also creates the opportunity for gifting and sharing between members and their families and friends.

Some amazing statistics are becoming evident as the power and ‘ultra-convenience’ of mobile payments emerges as a dominant driver of customer behaviour. In China, retail expert Angela Chang quotes the extra-ordinary effects of the integrated eco-system emerging between brands, retailers and consumers on mobile channels, resulting in a sales multiplier effect that she describes as a ‘glue – even more powerful than any loyalty programme‘. While we don’t have the same powerful eco-systems anywhere else in the world to match the Alibaba/Tencent effect, it’s clear that putting the power in consumer’s hands to allow them to shop on their mobile, creates ‘chaotic, addictive and fun’ shopping behaviours, the likes of which we have never seen before.

There are some challenges to be considered of course with the decision to include the facility to allow payments in your loyalty app. Clearly the potential for compelling customer adoption must be the driving factor, and we believe that our industry is uniquely placed to benefit from this emerging behaviour. Already there are opportunities for your convenience store app to offer digital coupons, allowing you to extend your retail reach way beyond your own space to connect your customers to the online stores they love to shop with. This allows them to shop online any time day or night, and collect their eCommerce purchases from your store at a time that suits them. Ultra-convenient for them. Incremental footfall for you.

Contact us if you’d like to discuss ways to include payment functionality within your customer loyalty apps and create compelling new reasons for your customers to engage.

About Us:

Liquid Barcodes is a leading global loyalty and digital marketing technology company specialized for the convenience store and foodservice industries. Our proprietary cloud-based technology platform allow retailers to create and manage their digital marketing campaigns with a proprietary process we call the “customer connection cycle’ to engage, promote and reward customers activities in real-time across digital and media channels.

How we do it:

We have developed the most advanced loyalty and digital marketing technology platform specifically for convenience store and foodservice retailers globally.

Retailers use our self-service dashboard to create and manage loyalty driven marketing campaigns that increase purchases with their existing customers, as well as effectively target and acquire new customers through partners or paid media channels.

One core component of live loyalty is gamification. We have gamified branding, loyalty and promotions. We believe this approach is essential in order to get customers’ attention and ultimately truly engage them with repeatable actions thereby winning their loyalty.

Check out some of our exciting/proven results here:

About Me:

Chief Content Officer, Liquid Barcodes and Independent Loyalty Consultant.

With over twenty-five years marketing experience, I specialise in loyalty marketing consulting, managing consumer loyalty propositions, strategy and operations. In addition to working with Liquid Barcodes, my clients have included Telefonica O2, Three Mobile, Electric Ireland, Allied Irish Bank and The Entertainer, as well as Avios – the global points currency for some of the world’s top airlines. I am also a judge for the Loyalty Magazine Awards.

—————————————————————————————–