Digital prepaid cards are, in our view, one of the biggest opportunities currently being missed by so many brands in convenience retail.

Despite the success and simplicity of selling physical gift cards to customers, many retailers have yet to take the next step of adding a digital prepaid card to their app, focused on specific products that customers love and buy regularly. So they are missing out on the incredible benefits that come with this genius idea, which is one reason that the term “Bank of Starbucks” has become increasingly popular in recent years!

A 2014 article on Wired.com cleverly explained how Starbucks was perfectly positioned to replace your bank and was followed in 2016 by a MarketWatch article which pointed out that “Starbucks has more customer money on cards than many banks have in deposits”.

So while most convenience retailers are not looking to disrupt the banking industry, Starbucks’ success in charging customers in advance for their coffee does highlight the opportunity for you to offer prepaid cards to your customers for their favourite products they are going to buy anyway.

As Liquid Barcodes, we’ve been successfully operating digital pre-paid cards for almost ten years for visionary brands like 7-Eleven in Denmark. And right now, it seems that the effects of the global pandemic have created the “perfect storm” conditions to convince more and more retailers that now is the time to enjoy the power of prepaid.

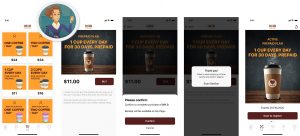

This article, and the images below, showcase the key benefits to both consumers and retailers for this simple, digital win-win concept.

Step One: “Great value coffee when you prepay” – this a simple, powerful proposition for both brands and consumers.

Step Two: The simplicity of prepaid.

Customer Benefits of Digital Prepaid Cards.

- Customers love great value, and they immediately understand this simple *win-win* idea of getting a great deal by simply paying upfront for a product they know they will buy anyway. It makes them feel appreciated because you show how much you value their loyalty. For example, you could offer thirty days of coffee for a super attractive price – but only when it’s *prepaid*.

- Because of the value and cash flow benefits when customers prepay, Starbucks offers DOUBLE stars for all purchases on its prepaid cards. Customers love this effortless way to earn more points.

- Customers love being in control. With a prepaid card, they are simply buying something in bulk that previously they would have bought repeatedly.

- A prepaid card is product-specific, so customers don’t worry about forgetting to use the value like we often do with generic gift cards.

- Their prepaid card is bought as a one-off purchase, so customers don’t have to worry about it automatically or unintentionally renewing as can happen with a subscription.

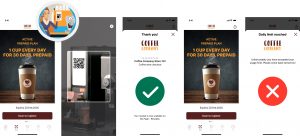

- As a digital prepaid card works by simply scanning its QR code, each transaction is frictionless, contactless and faster all around.

Business Benefits of Digital Prepaid Cards

The business benefits of prepaid cards are as follows:

- Customers who have prepaid for a product become both emotionally and functionally loyal to your brand. You can expect a 100% share of your customers’ wallets in the category they have prepaid. Plus any cross-sell or up-sell purchases that they are more likely to make just by being in your store more often.

- With the payment step completed in advance, each purchase is faster and removes the need for customers to queue to pay for their daily coffee.

- With customers identifying themselves for each transaction, your business can benefit from the data and insights available over time – understanding who is buying what and when. This enables ever-more efficient marketing.

- Customers spend more easily when they have a card “on file”, so a prepaid proposition gives the customer a reason to upload a payment card to you. This step removes friction from every purchase.

- As well as being valuable to you, payment brands such as Visa and Mastercard want to encourage customers to put their card “on file” with retailers they shop with regularly. We wrote about this previously, so there are opportunities for you to discuss this idea with your payment partners who may subsidise campaigns that benefit both you and them.

- With the Liquid Barcodes loyalty marketing platform, you can easily offer bonus loyalty points for a prepaid purchase of any number of products, further increasing the likelihood of driving repeat purchase behaviour.

- Our favourite benefit of prepaid cards for your business is the role they play on the path to subscription. Once customers are comfortable pre-paying for their favourite product and experience the simplicity of simply scanning to pay, it’s only a matter of time before they are happy to trial a subscription plan. A subscription programme then ensures ongoing, recurring revenue for your stores, as well as the 100% share of your customer’s wallet as mentioned above.

With such compelling benefits for customers, it’s no wonder that industry leaders such as Reitan Convenience have been offering their customers’ prepaid cards for so many years in almost all markets they operate in.

7-Eleven in Denmark’s prepaid proposition is a simple Idea that customers love.

Buy Once, Use Five Times

Global Case Studies

Along with industry leaders who so far have only offered prepaid deals to their customers, many tell us they are now working on the next phase of this idea – subscriptions.

They love the similarities between a prepaid deal for one product category like coffee from 7-Eleven shown above, and subscription deals like Circle K’s “Sip and Save” which offers 30 cups at great value for subscribers over 30 days. In both cases, customers get a great deal, keep their card on file, and have committed to shopping exclusively for these specific products with their prepaid coupons and subscription coupons.

Even if you have no plans to launch a subscription programme in your store, the simplicity of setting up a prepaid option for your top products is a great way to delight your customers in the months and years ahead.

7-Eleven, Starbucks, the Coffee Club, Joe & the Juice and Kauai all offer digital prepaid cards for customers.

About Us:

Liquid Barcodes is a leading global loyalty and digital marketing technology company specialising in the convenience store and foodservice industries. Our proprietary cloud-based technology platform allows retailers to create and manage their digital marketing campaigns with a proprietary process we call the “customer connection cycle’ to engage, promote and reward customers’ activities in real-time across digital and media channels.

How Can You Create Digital Prepaid Cards:

We have developed the most advanced loyalty and digital marketing technology platform specifically for convenience store and foodservice retailers globally.

Retailers use our self-service dashboard to create and manage loyalty-driven marketing campaigns that increase purchases with their existing customers, as well as effectively target and acquire new customers through partners or paid media channels.

One core component of live loyalty is gamification. We have gamified branding, loyalty and promotions. We believe this approach is essential in order to get customers’ attention and ultimately truly engage them with repeatable actions thereby winning their loyalty.

Check out some of our exciting/proven results here:

About Me:

Chief Content Officer, Liquid Barcodes and Host of “Let’s Talk Loyalty” Podcast

With over twenty-five years of marketing experience, I specialise in loyalty marketing content. In addition to working with Liquid Barcodes, my consulting clients have included Telefonica O2 Priority, Three Mobile, Electric Ireland, Allied Irish Bank and The Entertainer Group (UAE), as well as Avios – the global points currency for some of the world’s top airlines. I am also a former judge for the Loyalty Magazine Awards and proud host of the “Let’s Talk Loyalty” podcast – the industry’s first podcast for loyalty marketing professionals.

—————————————————————————————–